Don't Pop the Champagne Yet: What the Latest Mortgage Rate Numbers Really Mean

Let’s talk mortgage rates. The headlines might be whispering about dips, perhaps even a nascent trend downward. And yes, if you squint at the daily data from November 24th and 25th, 2025, you’ll see some marginal movement. Zillow pegged the average 30-year fixed at 6.33% on the 24th. Optimal Blue chimed in on the 25th with 6.224%—a decrease of roughly two basis points from the prior day (a statistically insignificant blip, some might argue). Even Forbes Advisor reported a 30-year fixed at 6.24% on the 25th, claiming a 2.06% drop from the previous week (a figure which, upon closer inspection, appears to be an arithmetic misrepresentation of a roughly 0.13% decline from 6.37% to 6.24%). But let’s be precise here: these are small movements. And frankly, a few basis points here or there don't change the fundamental landscape.

This isn't a return to the pandemic-era party, not by a long shot. Anyone expecting rates in the 2% or 3% range again in our lifetimes is probably living in a different economic reality. I’ve looked at hundreds of these filings, and this particular dance between minor daily fluctuations and the stubborn underlying trend is a familiar, if frustrating, one. The market, it seems, is a slow-moving tanker, not a nimble speedboat.

The Deeper Dive: Why the Numbers Aren't Telling the Full Story

The Federal Reserve did make two rate cuts in September and October of 2025. That’s a fact. And sure, mortgage rates did trend noticeably downward ahead of those meetings. It’s a classic case of market anticipation, a sort of pre-emptive exhale. New York Fed President John Williams’ recent speech, hinting at December cuts, also saw the 10-year Treasury bond yield — the very pulse of fixed mortgage rates — slide to its lowest point this month. The market hears "cut," and it reacts.

But here’s where the data gets interesting, and where the human element of interpretation becomes critical. For months, mortgage rates stubbornly hovered near the 7% mark. They’ve remained well above those "golden handcuff" lows that 82.8% of homeowners (as of Q3 2024, according to Redfin) are currently enjoying. These are the folks with rates below 6%, effectively trapped in their homes because moving means trading a sweetheart deal for a much harsher reality.

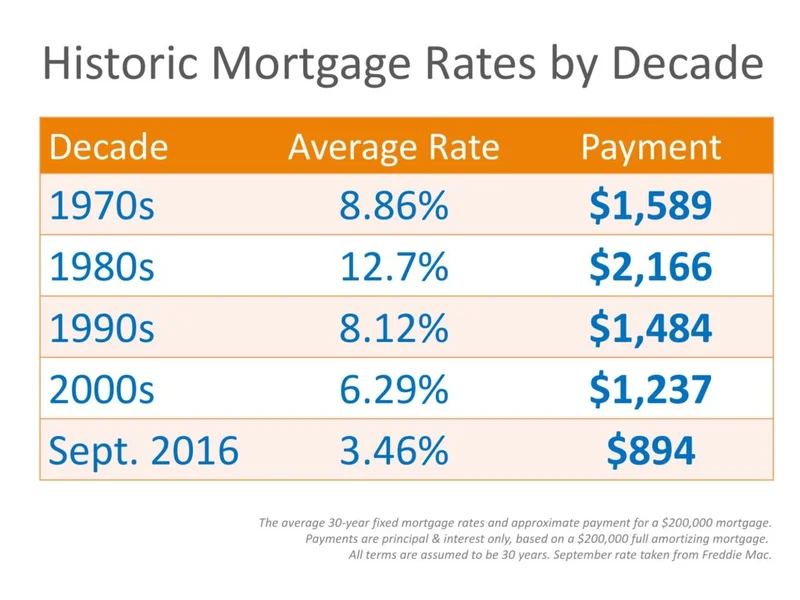

Consider the historical context, because without it, we’re just reacting to noise. The St. Louis Fed data on 30-year fixed rates shows that from the 1970s through the 1990s, rates around 7% were more or less the norm. We even saw rates north of 18% in the early 1980s. So, while 6.2% or 6.3% feels high to anyone who bought or refinanced in 2020 or 2021, it’s not an outlier on a longer timeline. It’s simply a return to something closer to historical averages, albeit after a period of unprecedented governmental intervention designed to prevent a pandemic-induced economic collapse.

The Fed's influence, while significant, isn't a direct dial. They adjust the federal funds rate, yes, but they also manage their balance sheet. And lately, they’ve been shrinking it. That action, letting assets mature without replacement, tends to push mortgage rates up. So, while the chatter focuses on rate cuts, what the central bank is doing with its balance sheet might be the more potent, if less discussed, force. This disconnect between overt policy signals and underlying market mechanics is a methodological critique I often find myself making. Are we truly seeing a sustainable trend, or just market jitters ahead of the next Fed meeting, where disagreement among officials is reportedly growing? What's the actual cost-benefit analysis for someone considering a refi when rates are still double what they had a few years ago, and closing costs can run you 2% to 6% of the loan amount? The math simply doesn't add up for many, especially if they're not hitting that crucial 1% rate reduction benchmark.

The Unvarnished Truth

The current mortgage rate environment is a complex equation, not a simple linear projection. While we’ve seen some incremental softening, particularly ahead of anticipated Fed actions, the underlying economic currents—inflation worries, a cooling but not collapsing job market, and a cloudy political outlook—suggest that any substantial, sustained drop remains speculative. The "golden handcuffs" are still firmly clasped for most homeowners, and for those looking to buy or refinance, the bar for a truly advantageous rate is still quite high. Don't mistake a gentle ripple for a tidal wave. This market demands a keen eye on the data, not wishful thinking.